Blaige & Company announced that its clients, Action Point, Inc., together with Signature Flexible Packaging, Inc. have merged to create a powerful new platform, and brought on a new capital investor, H.I.G. Capital to accelerate growth of the platform.

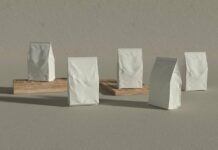

Action and Signature specialize in printing, conversion and supply of rollstock, pouches, and bags used for flexible food and consumer packaging applications. The Company serves small-to-medium sized consumer packaged goods companies across snacks, meats, candies, and baked goods. Headquartered outside Los Angeles, Action and Signature operate out of 3 facilities in Carson, CA, City of Industry, CA and Commerce, CA. The Company will continue to be led by Adrian Backer, founder and CEO of Signature, Federico Giacobbe, Executive Vice President and partner at Action, and Howard Applebaum, founder of Action and partner in Signature.

Action and Signature have been leaders in Southern California flexible packaging and possess a heritage and strong reputation for quality flexible packaging dating back nearly six decades. The Company has a unique, service-oriented culture, which has achieved decades of consistent growth. While they have had substantial cross ownership and cooperation over the past 15 years, the formal combination will herald greater levels of service, vertical integration, leading IT/logistics technology, strong brand identity, and a platform for add-on acquisitions to provide additional products, capabilities, and a broader footprint from which to serve customers.

Blaige & Company CEO, Thomas Blaige, commented on the transaction, “We have worked with the Companies over a two-year period to develop a detailed joint business model which was summarized in a compelling Confidential Information Memorandum, demonstrating the strength of a combined platform. Despite the pandemic, the focused marketing process brought forth multiple options and culminated in the selection of the best partner for establishing and growing the platform.”

Howard Applebaum commented, “The industry continues to evolve quickly and this transaction advances and solidifies the Companies’ strong market position and its leadership status with global customers we have been serving for two or three decades. I am very proud of Adrian and Federico, Art Rosen, and our associates, who make a difference every day at Action and Signature. We have found a great partner in HIG, with which to create greater opportunities for everyone involved going forward.”

Adrian Backer, commented, “Now that the combination is complete, the customers will profit from a yet higher level of service. Through a significant investment in technology, this establishes a platform that competes on a national scale.”

Federico Giacobbe commented, “I continue to be impressed with our ability to provide customers with top products and services yet retain a very entrepreneurial and family culture, which has been key to our competitive advantage. The combination not only expands our capabilities but also enhances the unique culture, which both Action and Signature share.”

H.I.G. Capital is a leading global private equity and alternative assets investment firm with $42 billion of equity capital under management. Based in Miami, and with offices in New York, Boston, Chicago, Dallas, Los Angeles, San Francisco, and Atlanta in the U.S., as well as international affiliate offices in London, Hamburg, Madrid, Milan, Paris, Bogotá, Rio de Janeiro, and São Paulo, H.I.G. specializes in providing both debt and equity capital to small and mid-sized companies, utilizing a flexible and operationally focused/ value-added approach. Since its founding in 1993, H.I.G. has invested in and managed more than 300 companies worldwide. The firm’s current portfolio includes more than 100 companies with combined sales in excess of $30 billion.

Blaige & Company, with offices in Miami and Chicago, is an investment bank dedicated exclusively to the packaging, plastics, and chemicals industries. Blaige & Company has over 35 years of transaction experience, has completed over 200 transactions, and has visited and assessed over 600 packaging, plastics, and chemical operations worldwide. Blaige proprietary packaging M&A deal research sets the industry standard – the Blaige research team compiles and analyses over 500 global packaging, plastics, and chemical industry transactions annually. Recently, London-based magazine Acquisition International named Mr. Blaige “Sector Focused C.E.O. of the Year”, and Blaige & Company “Sector Focused Investment Bank of the Year”.