The paper and packaging industry stabilized following a lockdown-related boom, but 2023 has indeed been a volatile year because of rising expenses as well as supply chain issues brought on by high interest rates, Brexit, conflict, as well as economic instability.

Moving forward to 2024, one can expect significant changes in how companies go on to respond to protect their profit margins, safeguard their businesses, and at the same time meet the demands of consumers along with the market.

It is well to be noted that there are 5 major trends that are expected to make prominent impact on paper and packaging industry next year:

As the price of paper dips, it is more important to safeguard profit margins

Right from June 2020 to January 2023, the prices of paper almost doubled due to various elements such as dips when it comes to commodities, surging energy prices, effect of Brexit, and at the same time rising costs when it comes to freight. Apart from this, a substantial surge in e-commerce because of nationwide lockdowns was witnessed, which caused a significant surge in home deliveries.

In 2024, paper and also packaging manufacturers will most probably begin to reduce prices on a consistent basis.

Buoyancy in e-commerce

In the five years that have gone by, one has gone on to see a decline in terms of high street as consumers prefer the convenience as well as affordability of online shopping in a more consistent way. This shift in consumer behavior has led to the shutdown of well-known stores such as Topshop and Wilkinsons. The fact is that the move towards increased online spending gained a significant rise during the national lockdowns that came into effect in 2020. According to Ofcom, this went on to result in a 48% YoY surge, amounting to £116 billion. The significant increase in deliveries led to a surge in packaging material demand.

While a slight decline of 0.3% did take place in online retail sales in September compared to the previous month, the sales numbers of 26.7% still go on to indicate a market that’s strong and thriving. Additionally, these numbers happen to be significantly higher than the sales recorded during the same period in 2019 at 18.1%. Given the evolving consumer demand and spending trends, there is a buoyancy that goes on to suggest a chance for agile paper and packaging suppliers in 2024.

Greater utilization of bags

Progress in e-commerce has led to brown packing boxes going on to be a significant tool in the arsenal. There is a rising awareness among consumers regarding the alternatives they make use of and how they tend to be affected by the environment.

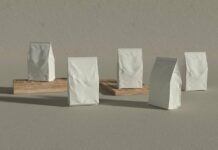

The pursuit of cost savings, teamed with this factor, is leading to a major shift towards the adoption of smaller as well as lighter packaging. Furthermore, there is a trend that’s surging of replacing boxes with bags as the preferred packaging option.

Although they are made of plastic, these bags happen to be recycled frequently. Additionally, their flexibility, size, and weight contribute to a significant amount of cost savings in transportation while at the same time providing environmental advantages.

Retailers happen to be increasingly exploring cost-cutting options for delivery. One emerging trend is the growing popularity when it comes to multi-use bags, which not only serve as a means of delivering products to customers but also offer the convenience of being used for returns. After the retailer receives the bag back, they reintroduce it into the recycling system.

There happen to be many benefits to using bags, which is why they are becoming increasingly popular when it comes to transporting goods. It is expected that in 2024, retailers will seek more efficient choices, and one may witness a broader utilization of bags.

Better use of boxes

Bags don’t happen to be always be able to perform the same tasks such as boxes. In certain situations, a standard cardboard box continues to be one of the most effective solutions.

In the current market scenario, companies are actively seeking ways to enhance their efficiency and also reduce costs. This involves going out of the way to adopting methods to enhance the efficiency of packaging utilization.

One can go on to expect that more companies will adopt an Ikea-style approach, where they will discover innovative methods so as to maximize the utilization of space within packaging, consolidate orders, as well as minimize packaging size. It doesn’t come as a surprise if this has a ripple effect on paper prices and producers.

Food, medicine, and pharmaceutical industries to remain strong

Given the fact that the economy happens to be in a precarious state and that the ongoing challenges of high living costs exist, it is expected that certain sectors, such as fast fashion as well as FMCG, will continue to get affected. This will have repercussions when it comes to the packaging sector in the coming year.

However, product and service demand in recession-proof categories will continue to remain stable. One essential aspect happens to be food. All need to eat, and in order to do so, packaging is essential. It is worth noting that gone are the times when butchers were permitted to wrap meat in yesterday’s newspaper.

Another sector that is anticipated to withstand economic challenges is the medical as well as pharmaceutical industries. The pharma sector tends to remain strong during economic downturns because of the essential nature of medicines. Medical packaging has gone on to become incredibly advanced when it comes to technology.